34+ percentage of net income mortgage

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Or 45 or less of your after-tax net income.

Free 34 Sample Application Letter Templates In Pdf Ms Word

Ad Check Todays Mortgage Rates at Top-Rated Lenders.

. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. If youd put 10 down on a 444444 home your mortgage would be about 400000.

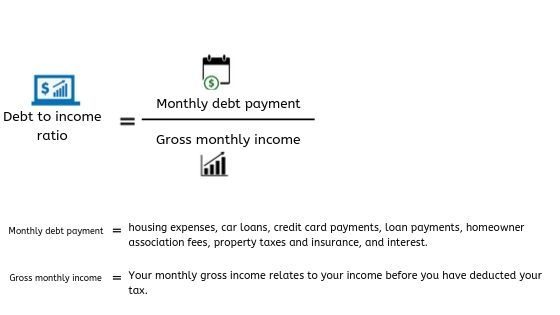

A front-end and back-end ratio. Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. For example if your monthly income is 5000 you can.

Ad Top Home Loans. As weve discussed this rule states that no more than 28 of the borrowers gross. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web How much income is needed for a 400K mortgage. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. In that case NerdWallet recommends.

Web There are some mortgage programs that allows prospective buyers to get a loan with as little as 3 down. Ad Get the Right Housing Loan for Your Needs. Compare More Than Just Rates.

And you should make. The 36 should include your monthly mortgage payment. Because these programs can be of higher risk to the.

This means that if you want to keep. Find A Lender That Offers Great Service. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 of your gross income on your monthly payment.

Compare Your Best Mortgage Loans View Rates. Web The 2836 is based on two calculations. Compare Apply Directly Online.

Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Compare Offers Side by Side with LendingTree. Web Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one.

So if your gross.

Catholic Syrian Bank Home Loan Interest Rate Starting 9 69 P A

Rent A Room What To Know About Renting A Room In A House

Child Care Expenses Of America S Families

Percentage Of Income For Mortgage Rocket Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

The Percentage Of Income Rule For Mortgages Rocket Money

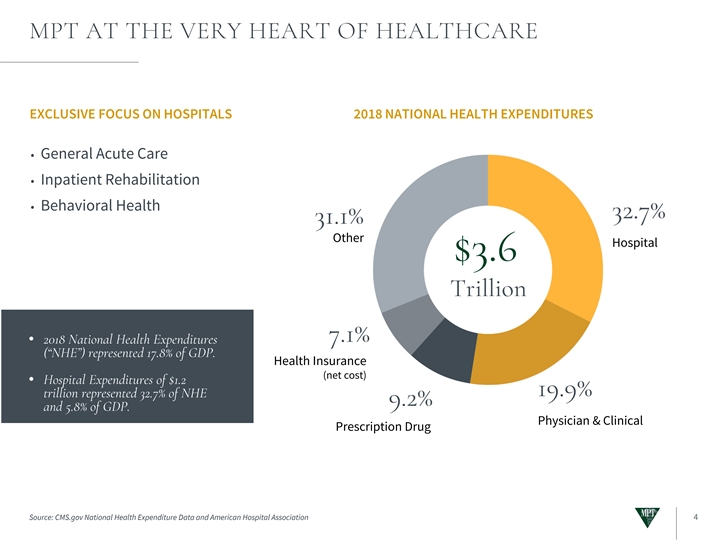

Ex 99 1

Why Mortgage Applications Get Rejected What To Do Next

Per Loan Mortgage Profits Hit Record High In Q3 2020 National Mortgage News

What Percentage Of Income Should Go To A Mortgage Bankrate

Child Care Expenses Of America S Families

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Your Mortgage Hometap

What Percentage Of Your Income To Spend On A Mortgage

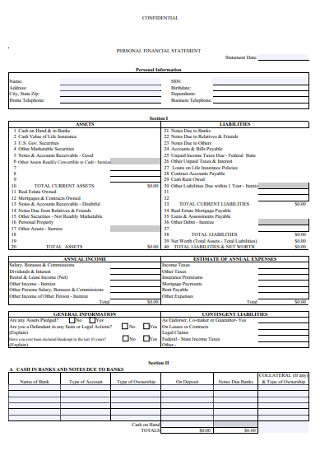

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

Au Bank Home Loan 12 5 Apply Now Get 90 000 Cashback